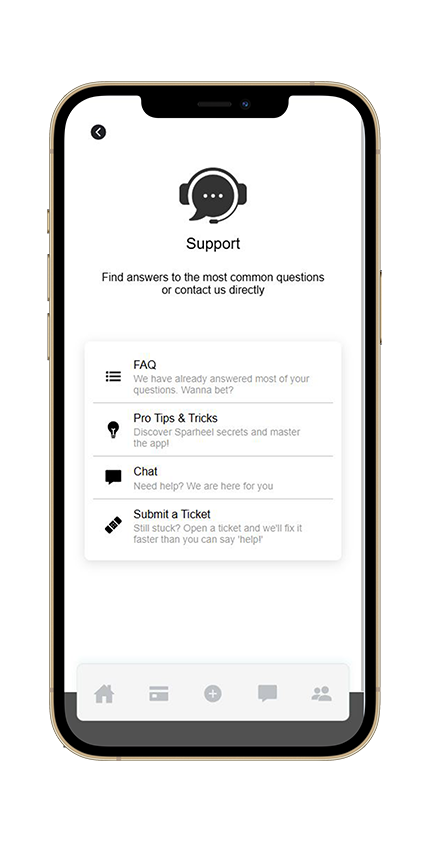

We know you might have questions about how Sparheel works, our fees, and how we create a community-driven lending experience. Below are answers to some of the most common questions. If you don’t find your answer, feel free to ask us directly.

Sparheel connects borrowers and lenders through a community-driven platform. Borrowers can access funds based on their trustworthiness and engagement, while lenders earn fair returns by funding loans with complete transparency.